- Home

- Payment Processing

- What are electronic funds transfers (EFT payments)? And how do I create one?

What are electronic funds transfers (EFT payments)? And how do I create one?

What is an EFT payment?

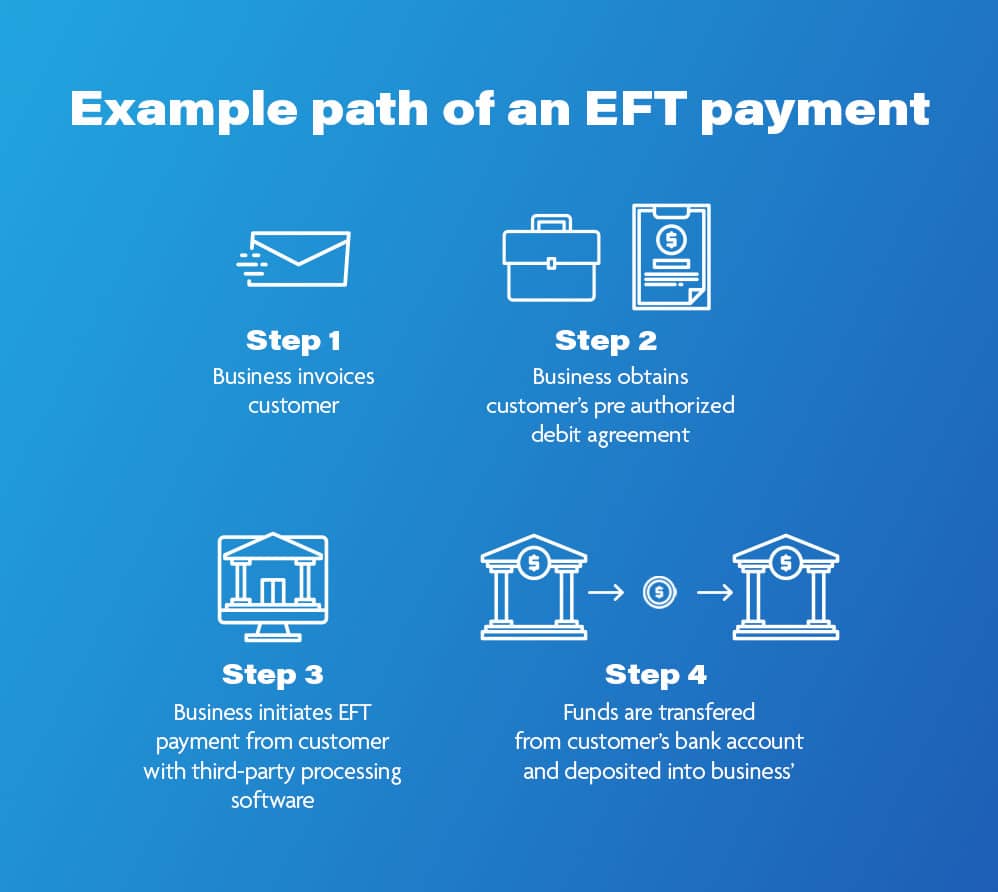

EFT stands for electronic funds transfer. An EFT payment is a bank to bank transfer initiated by a payee when the payor gives the authorization to do so.

These types of payments move money across a network, between banks, and frequently replace paper methods for making payments like cash or cheques.

You have probably sent or recieved EFT payments many times in your life, maybe without knowing it. Authorized your utilities or phone companies to automatically withdraw your monthly payments? That’s an EFT payment! Consumers, businesses, and government agencies use EFTs every day.

Pre-authorized debits and direct deposits are made possible by EFTs

Direct deposits are credits sent to a recipient’s bank account. Often, paycheques and government benefits are deposited this way. These are all done with an EFT.

Pre-authorized debits (PADs) are payments withdrawn from a bank account. PADs are typically used to charge recurring payments like rent, donations, utilities and more.

Businesses can use EFTs in these ways to send or receive payments from suppliers or clients. Customers can pay businesses faster and more reliably by using an EFT payment options. Sounds great, doesn’t it? Later in this post, we’ll outline more benefits of accepting EFT transfers.

How do businesses get started with EFTs?

If you want to accept EFT payments from your customers, you are legally required to receive authorization (and document it). The Canadian Payments Association is the governing body that outlines and regulates the rules of EFT payments in Canada. It may seem complicated at first, but it’s simple. Your customer agrees to pay you with an electronic funds transfer, and you’re not waiting for another payment ever again!

How to create an EFT agreement and get paid

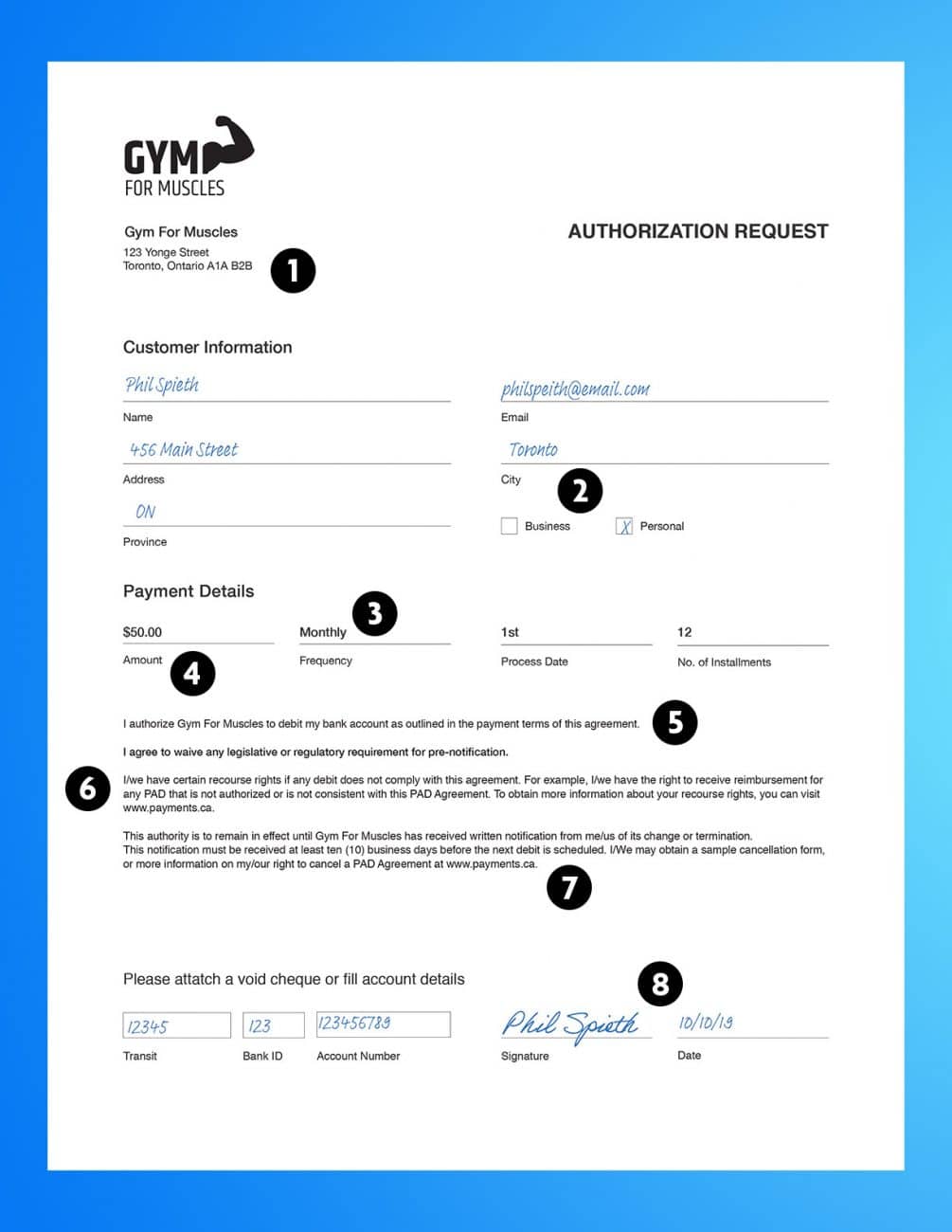

This is what an agreement looks like for an EFT payment:

If you follow along with the number guides, here’s an explanation of the 8 requirements of the EFT agreement.

![]() Contact Details – So the payor can get in touch with you.

Contact Details – So the payor can get in touch with you.

![]() Pre Authorized Debit Category – Is the payor a person or a business?

Pre Authorized Debit Category – Is the payor a person or a business?

![]() Timing – This outlines to the payor when the payments are to be taken out (i.e. weekly, monthly, bi-monthly, annual, on set dates or otherwise.) You also need to explain if each payment is to be triggered by a specified act, event or other criteria. If it’s to be triggered by a specific act, it needs to be clear on what that is.

Timing – This outlines to the payor when the payments are to be taken out (i.e. weekly, monthly, bi-monthly, annual, on set dates or otherwise.) You also need to explain if each payment is to be triggered by a specified act, event or other criteria. If it’s to be triggered by a specific act, it needs to be clear on what that is.

![]() Amount – So the payor knows how much is being taken from their account. If it’s an open or variable authorization, it needs to be clearly stated.

Amount – So the payor knows how much is being taken from their account. If it’s an open or variable authorization, it needs to be clearly stated.

![]() Authorization Statement – A clear statement that outlines authorization to withdraw funds from a particular account.

Authorization Statement – A clear statement that outlines authorization to withdraw funds from a particular account.

![]() Recourse Statement – So the payor understands their rights to stop the agreement.

Recourse Statement – So the payor understands their rights to stop the agreement.

![]() Cancelation Details – So the payor knows how to cancel the agreement.

Cancelation Details – So the payor knows how to cancel the agreement.

![]() Date of Agreement & Signature – If in a physical paper form

Date of Agreement & Signature – If in a physical paper form

The next step is to find a payment processor because, in order to withdraw money from your customers’ bank account, you will need to find a processor who can facilitate the payment. This is typically your bank or a third-party payment processor.

Finding a third party EFT processor

Unfortunately, bank systems are pretty complicated and do not integrate well with your accounting system. Third-party processors usually have integrations and give you a much more competitive rate for lower volume transactions. The user experience is also way friendlier.

At Rotessa, for example, we have a tool that creates an authorization form for your EFT payments. You can email customers with a unique and secure link that this tool provides.

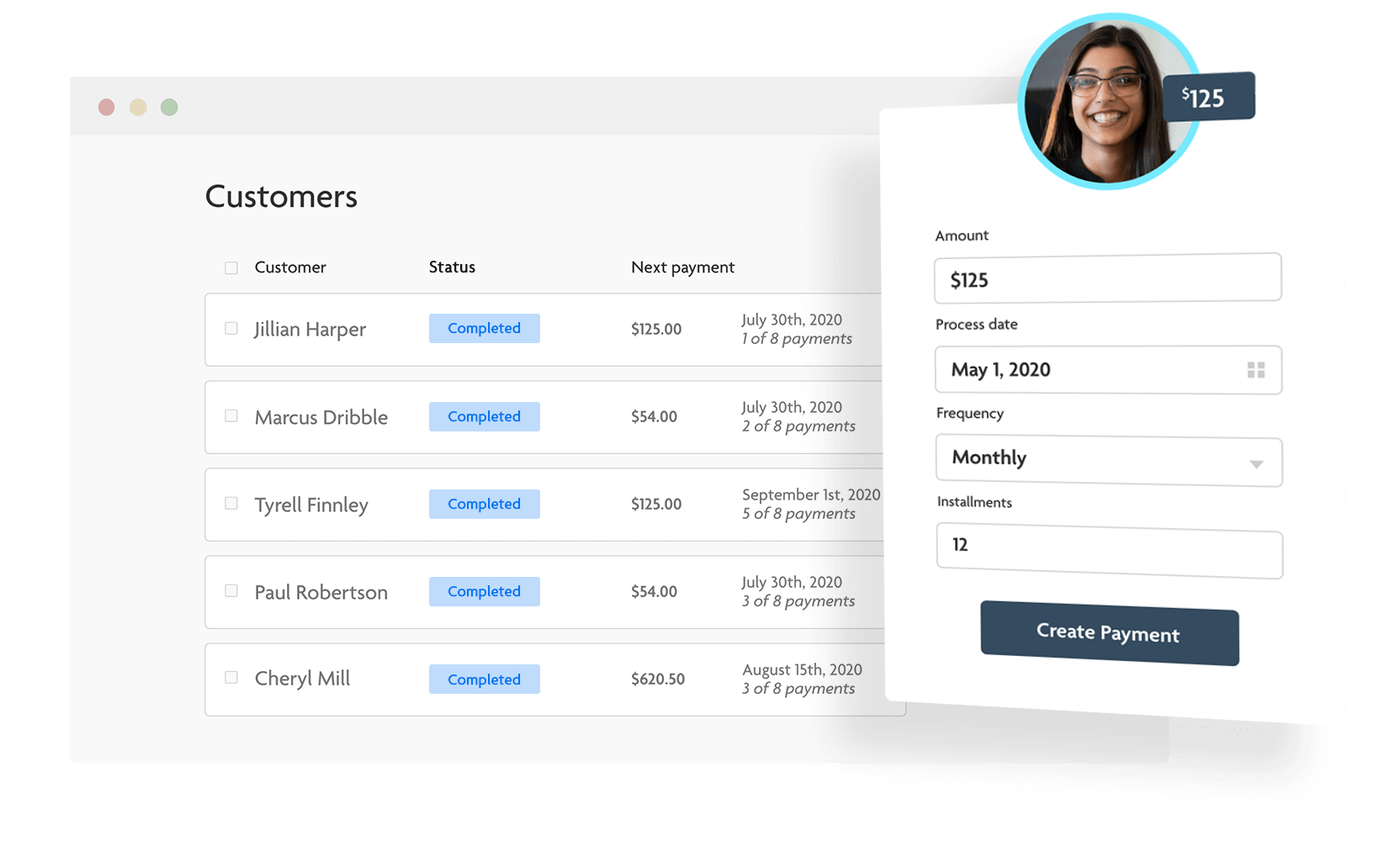

Setting up a payment

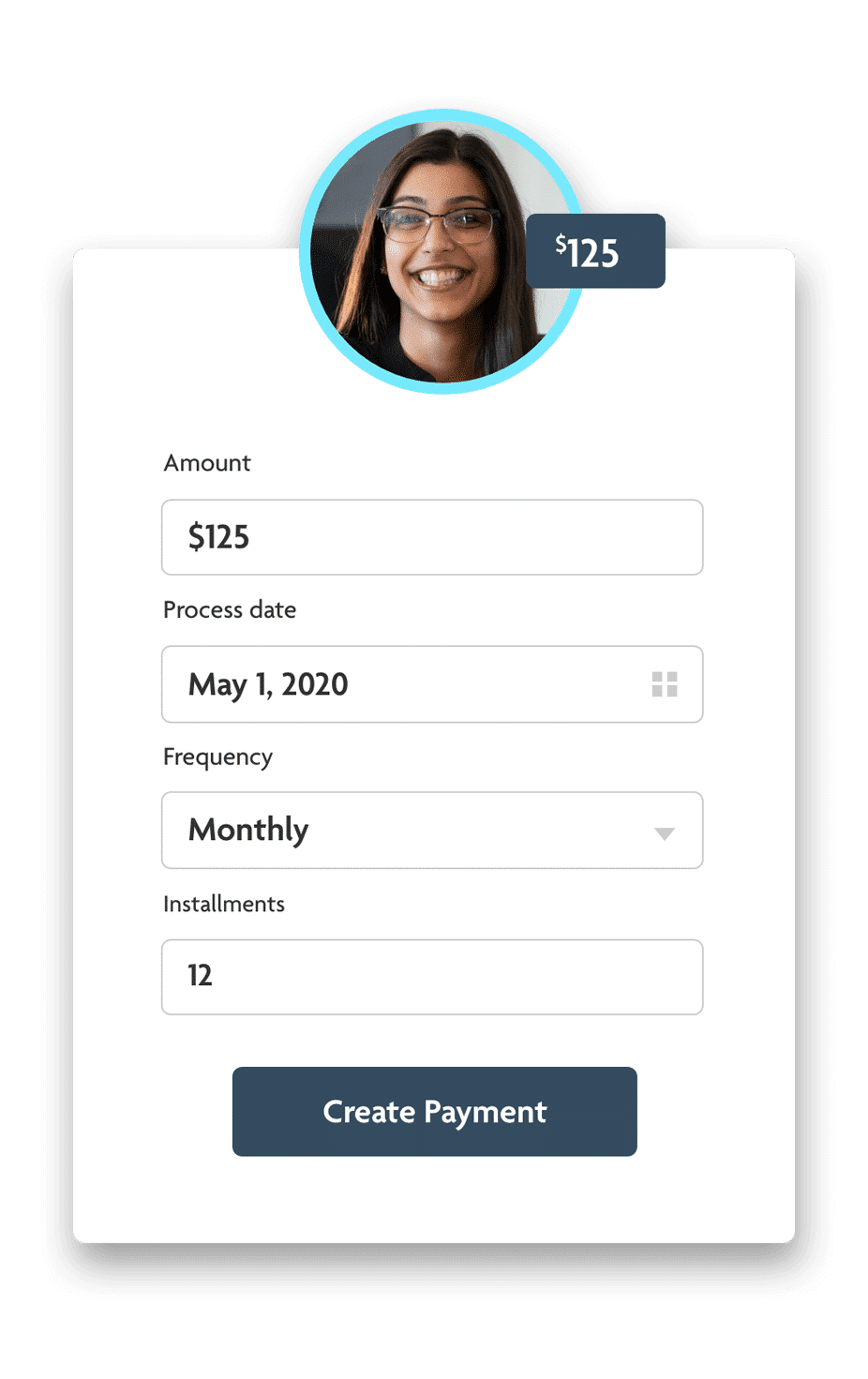

Once you’ve signed up with a processor you will get access to an online app. This app will allow you to set up and schedule payments from customers (once you get their EFT agreement). When setting up a payment, you need to outline the amount owing, the schedule and/or frequency of payments, and the number of installments.

Your EFT payments will now be automatically withdrawn from your customer’s account and deposited into yours according to the specified frequency and installment schedule.

With EFTs it is important that you remember that when you are scheduling payments, the processing date on your scheduled transaction is the day the money will be withdrawn from your customer’s account. With most processors, you will receive the settlement of funds a few business days later. Therefore, make sure to schedule accordingly.

On the settlement day, your payment processor will provide a settlement report of the EFT payments. With Rotessa, you get those reports for free and you can integrate them with your accounting software to reconcile those settled payments.

Four reasons to collect payments with EFTs

Reason 1: control

Most businesses receive payments by sending the customer an invoice and waiting for a credit card transaction or a cheque. This payment workflow can be a problem because it gives the customer the prerogative to initiate the payment. An EFT payment workflow, on the other hand, gives the prerogative to the business by allowing them to initiate payments from the customer.

As a business, you have no control over payments with credit cards and cheques. When you don’t have EFT payments set up, you are at the mercy of your customer and are probably waiting on them to pay you. You already provided your service, why should you allow your customers to choose when they pay for it? With EFT payments, you decide when payment is withdrawn from your customer’s bank account.

Reason 2: cost of credit cards

The true cost of credit cards is not beneficial to small businesses. Yes, you want to give your customers every opportunity to pay you, but how much does processing credit cards cost? Most online credit card processors charge 2.9% on every payment. So, if you invoice a client $500 you’ll be paying almost $15 just to process one payment!

EFT processors don’t charge a percentage fee (depending on which one you choose). With Rotessa, for example, that $500 invoice could cost as low as 30¢ to process! Businesses can save tens, hundreds or thousands of dollars every month with EFT payments.

Reason 3: timeline of cheques

Each time a customer sends you a cheque, you have to deposit it and reconcile it with your accounting platform. This is a time-consuming task that could be better spent on growing your business. With automatic EFT payments, you can schedule those payments in advance with no need to leave the office.

Reason 4: customer relationships

For many businesses, getting paid with other payment methods can create strained customer relationships. Not only is payment chasing frustrating, it can cause awkward confrontational interactions with customers. When a business and customer use an EFT they both agree on a processing date and an amount for the payment.

EFT payments give you the ability to collect payments easily, on a timely schedule, and with all the convenience of traditional digital payments. Want to give EFT payments a try? Simply set up a free Rotessa account!